What is the impact of this pandemic on my investment portfolio? And what can you do to protect your future wealth?

As always, I will remind you we cannot predict the future. That is not our job. But what we can do is try and find similar issues in the past and see what strategy we can adopt today.

I have just finished reading ‘Dying of Money’ which was written by Jens Parsson. It tells the history of the German inflation after World War I and the US inflation after World War II. How they happened and what you can do to protect your wealth from events like this. The interesting one for me was the German inflation.

The Germans lost the war, as we know, but based their finances leading into the war and during the war on the basis that they would win. War was followed by reparations and then the Spanish Flu pandemic. The Germans broke with the gold standard and entered a period of money printing. Initially this led to a boom in the economy and very little inflation to speak of, but suddenly inflation got a grip and in a very short period the German Reichsmark became worthless. You could order a cup of tea and by the time it was served to you it was 20% more expensive.

After WWI, the Reichsmark was worth 23 cents to the $1. By the end of 1923, the Reichsmark was 1,000,000,000,000 to a $1! If you were a German depositor or a lender, you lost it all.

The money supply was the main issue. There were many reasons why the supply of money changed, but if you print more money, creating more notes, you make what you have worth less. To give a simple example. Let us say that the entire spare cash in the world is £1 and it is owned by one person. Let us also say that the only thing you can buy is a field of grass from someone else. There is nothing else to buy, just that one field of grass. Then the field, theoretically could be worth £1. If I now print another nine notes and give £1 each to nine more people as spare cash, we now have £10 in total available, but there is still only one field to buy. What is the field worth now? So, what can we learn from this:

The nine people who got £1 each for doing nothing probably felt very happy!

The first person to have a £1 saw his purchasing power reduce by 90%.

The owner of the field retained their purchasing value.

Okay, that is a simple example, but we know that borrowing and spending in the western world and the printing of money; quantitative easing (QE), has been going on for years now. This virus has pushed all this out even further. There is no deposit interest to speak of and a great way of clearing all this debt, which cannot possibly be paid back in any reasonable length of time, is probably a savage bout of inflation.

So, who came out okay from the German Inflation, US inflation and my example? It was the people who owned real assets; shares in companies, home owners, land owners. Holders of precious metals as well. People who owned stuff.

Who lost? Those people who owned the money; bank depositors, cash and lenders.

And the big winners; Government and borrowers. Debts gone – happy days!

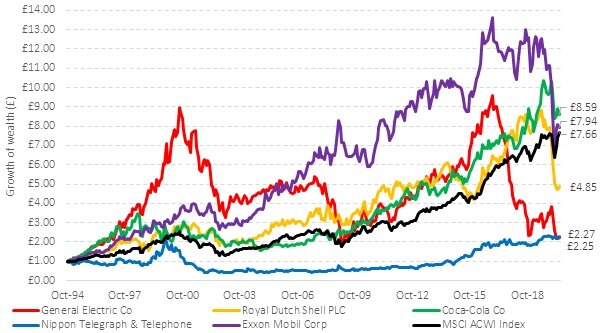

I believe we are now in unchartered territory. But history has shown that while shares can go up and down in value (as we have seen in recent months), they can be a good store of future long-term wealth, offering some inflation protection. There has never been a stock market that has gone bust, but there are several currencies that have disappeared!

Max Tennant

Risk Warning This newsletter does not constitute financial advice. Remember that your circumstances could change and you may have to cash in your investment when the value is low. The value of your investment and any income from it can go down as well as up and you may not get back the original amount invested. Past performance is not necessarily a guide to the future. If you are in any doubt you should seek financial advice.