Tapered Annual Allowance

The tapered annual allowance can be quite complicated to get your head around. We've put together a simple example to show how it works.

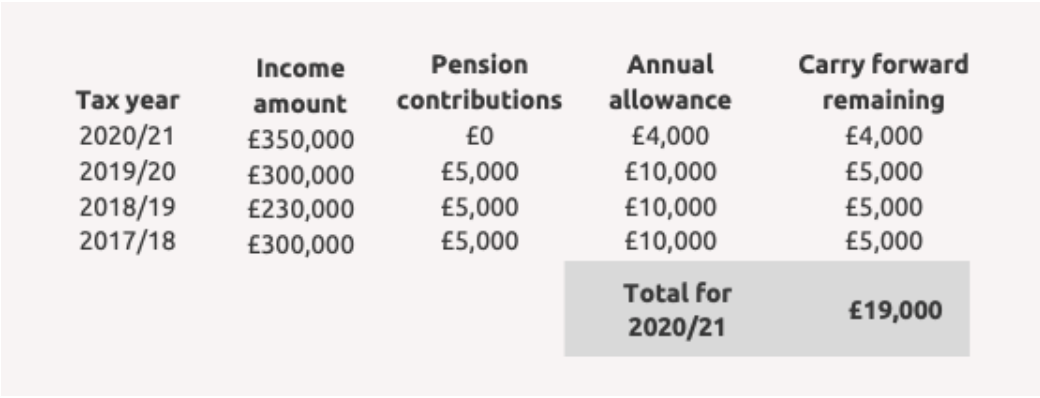

The table below aims to illustrate an individual affected by the tapered rules:

The tapered annual allowance rules kicked in on 6th April 2016, when those with taxable earnings over £210,000 per annum were limited to pension contributions of £10,000 gross each tax year. This was a controversial piece of legislation and also quite complicated. The rules were altered from 6th April 2020, whereby those earning in excess of £312,000 are now limited to an annual allowance of £4,000. This has made planning for self-employed individuals quite tricky, especially for those that have a tax year end of 31st March each year. Some good news, the carry forward rules still apply to those affected by the taper.

Nothing contained in this article constitutes or should be construed to constitute investment, legal, tax or other advice. The information contained in this article shall in no way be construed to constitute a recommendation with respect to the purchase or sale of any investment.