We thought it would be helpful to send some initial thoughts following the budget. Business owners and those with significant pension assets are now faced with a completely different situation, which could affect ongoing planning.

Here is a summary of some of the most significant changes announced.

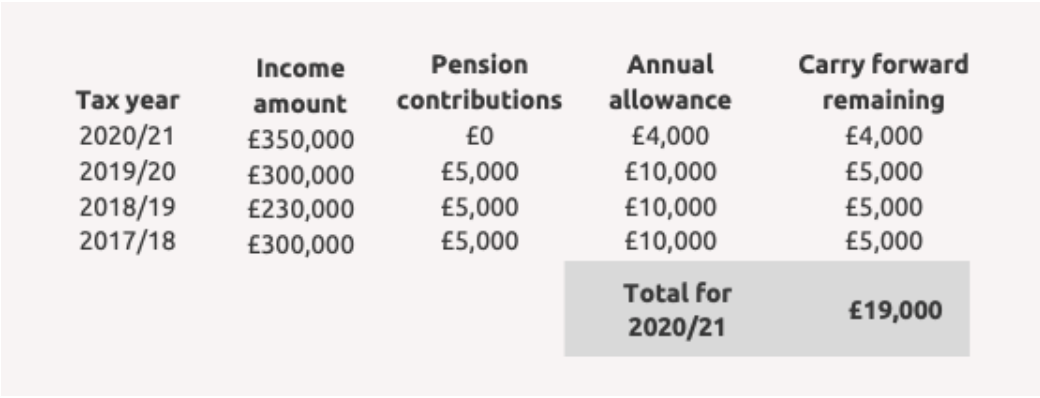

Pensions

Rumours about changes to tax-free cash, pension tax relief, and the lifetime allowance were unfounded. Instead, the government announced it would bring unspent pension pots into the inheritance tax (IHT) scope starting April 2027.

This is a huge change for those with pension assets and will likely lead to a massive increase in tax revenue over the coming years. The usual spouse/civil partner exemption should still apply, which makes it particularly important to have an up-to-date expression of wish on file.

Strategies to improve your tax situation are already being developed internally, and we will communicate these with you individually.

Business Asset Disposal Relief (BADR)

Business Asset Disposal Relief (BADR), formerly Entrepreneurs Relief, will remain at 10% this tax year before rising to 14% on 6 April 2025 and 18% from 6 April 2026. The lifetime limit will be maintained at £1 million, while the lifetime limit of Investors’ Relief will be reduced from £10 million to £1 million.

This change will result in business owners paying considerably more tax when selling their businesses. Many may consider bringing forward a disposal before the 18% kicks in.

Agricultural relief and business relief

This is a tax on the sale of farms and unlisted businesses (typically family-owned assets). Historically, these have been able to pass to the next generation without a tax charge. The logic behind this was that the businesses would then be able to continue. If a large tax charge is due, the business asset may need to be sold if no other assets are available to pay the tax charge.

From 6 April 2026, 100% relief will remain for the first £1 million of combined agricultural and business assets. Above £1 million, the relief will be 50%; this would mean IHT at 20% above £1 million. Thus, it is more important to make a plan to pay any potential inheritance tax bills using alternative assets.

Capital Gains Tax (CGT)

While the CGT threshold (£3,000) remains unchanged, tax rates will increase. The new rates take effect immediately.

The lower rate will rise from 10% to 18%.

The higher rate will increase from 20% to 24%.

This aligns CGT rates paid on non-property and property assets.

As always, we will consider these new rates before making any capital gains chargeable decisions on clients' investments.

Second Homes

The Additional Dwelling Stamp Duty Land Tax (SDLT) rate will increase from 3% to 5% starting immediately. This will affect those looking to enter or increase their holdings in the buy-to-let market or purchase a holiday home.

Summary

The announced changes need to be passed through legislation as part of a new finance bill. We should find out more about the intricate details of each change as the days and weeks pass. The changes highlight the importance of having an up-to-date financial plan. We will assist our clients with any planning that needs to be done following these changes.

Risk warning

This article is distributed for educational purposes only and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Reference to specific products is made only to help make educational points and does not constitute any form or recommendation or advice. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.