ISAs vs Pensions: Understanding the Role Each Plays in a Strong Retirement Plan

When people think about saving for retirement, the conversation often becomes a straight comparison:

ISAs or pensions – which is better?

In reality, this is rarely the right question.

At Ifamax Wealth Management, we believe good retirement planning is about understanding how different tools work together, how tax rules evolve, and how to build flexibility into your plan so it can adapt, not just for your retirement, but potentially for future generations too.

Different Tools, Different Roles

ISAs and pensions are both highly tax-efficient, but they serve different roles within a long-term financial plan.

ISAs provide flexibility, accessibility and tax-free certainty

Pensions provide powerful tax relief, long-term growth potential and unique estate-planning advantages

A well-structured retirement plan often uses both, carefully balanced around income needs, tax efficiency and family circumstances.

ISAs: Flexibility and Simplicity

ISAs are often the most intuitive savings vehicle and play an important role in retirement planning.

Key ISA benefits

Tax-free growth (no income tax or capital gains tax)

Tax-free withdrawals at any time

No minimum access age

No restrictions on how or when money is taken

This makes ISAs particularly useful:

In early retirement before pension access

As a tax-free income top-up alongside pensions

For funding one-off or irregular expenses

What happens to ISAs on death?

A spouse or civil partner can inherit the ISA’s tax-free status via an Additional Permitted Subscription

Other beneficiaries (such as children) do not inherit the tax-free wrapper

Once funds leave the ISA, they become part of the recipient’s taxable environment

ISAs can support estate planning, but they are not primarily designed as an intergenerational wealth-transfer vehicle.

Pensions: Tax Efficiency, Growth and Long-Term Planning

Pensions remain one of the most powerful tools available for retirement planning, particularly when viewed over decades rather than years.

Key pension advantages

Tax relief on contributions (subject to allowances)

Tax-free growth within the pension

Flexible access from age 55 (rising to 57 from 2028)

The ability to control income through drawdown

Strong planning options on death

For many clients, pensions form the core foundation of their retirement strategy.

Pensions and Inheritance: Separating Headlines from Reality

There has been considerable attention on pensions and inheritance following recent Government announcements. While the rules are evolving, pensions still play a central role in long-term and intergenerational planning.

Income tax treatment on death

Death before age 75: beneficiaries can usually draw income tax-free

Death after age 75: withdrawals are taxed at the beneficiary’s marginal rate

Importantly, where a pension offers full beneficiary drawdown, there is no requirement to take the money immediately, allowing income to be spread over time and managed tax-efficiently.

If a beneficiary later dies, the pension can usually be passed on again, with tax treatment based on their age at death rather than the original pension holder’s.

Government Changes: What’s Actually Changing — and What Isn’t

Inheritance Tax on Unused Pension Funds (from April 2027)

The Government has confirmed that unused pension funds and death benefits will, in future, fall within the scope of Inheritance Tax.

This is a significant shift, but it’s important to keep perspective:

Pensions still benefit from decades of tax-relieved growth

Income tax treatment on death (pre- and post-75) continues to apply

Many families will still benefit from pensions being passed on gradually rather than as a single taxable lump sum

The planning emphasis shifts from “avoid tax entirely” to “manage tax over time”

In other words, pensions are not suddenly “bad” assets to leave behind; they require more thoughtful structuring.

Salary Sacrifice Reform for Pension Contributions (from April 2029)

The Government has also announced reforms to salary sacrifice arrangements for pension contributions.

Currently, salary sacrifice offers an additional benefit by reducing National Insurance for both employees and employers. From April 2029, this advantage will be reduced or removed for many arrangements.

What this means in practice:

Pension tax relief still applies

Salary sacrifice may become less attractive at the margins

Employer pension funding and contribution strategy will need review

Business owners and senior employees may need to rethink how contributions are structured

Again, this doesn’t make pensions unattractive; it simply reinforces the need for ongoing planning rather than static assumptions.

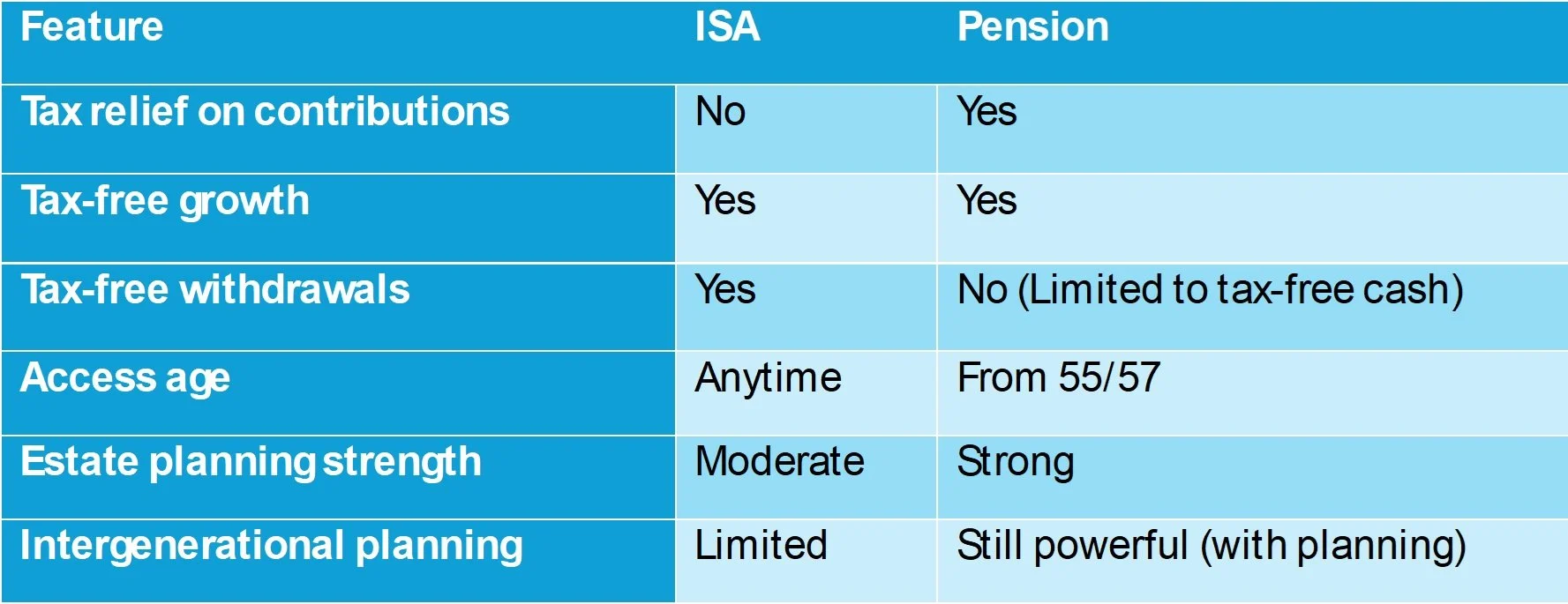

ISAs vs Pensions: A Planning Comparison

Why the Answer Is Rarely “ISA or Pension”

In reality, the most effective retirement plans combine:

Pensions for long-term growth, tax relief and structured inheritance

ISAs for flexibility, tax-free income and control

This combination allows:

Greater income-tax control in retirement

Flexibility as rules change

More options for spouses and future generations

The Ifamax View: Planning Through Change

Tax rules will continue to evolve. Headlines will come and go.

At Ifamax, our focus has always been on building financial plans that adapt, not chasing short-term tax advantages.

We start by understanding:

What retirement really looks like for you

How income needs will change over time

How much flexibility you value

What role should your wealth play beyond your lifetime

Only then do we structure pensions, ISAs and other assets around a plan designed to grow, protect and pass on wealth as tax-efficiently as possible, whatever the rules may be.

Important note

Tax treatment depends on individual circumstances and scheme rules. Not all pensions offer full beneficiary drawdown options, which is why reviewing arrangements and taking professional advice is essential.

This article is distributed for educational purposes only and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Reference to specific products is made only to help make educational points and does not constitute any form or recommendation or advice. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.