State Pension Changes: What You Need to Know and How They Affect Your Retirement Plan

State Pension Changes: What You Need to Know and How They Affect Your Retirement Plan

The State Pension has been part of the UK’s financial landscape for more than a century, but its purpose and the way we plan around it have changed dramatically over time. At Ifamax Wealth Management, our Bristol-based financial planners help clients understand how the State Pension fits alongside their broader retirement strategy, ensuring it becomes a foundation for a secure, tax-efficient future.

Below, we outline the key changes, what the State Pension looks like today, and why it remains such an essential part of your long-term plan.

A Brief History of the UK State Pension

The modern State Pension has evolved significantly since its introduction:

1908 – The Old Age Pensions Act

The first universal state pension paid 10–25 pence per week.

Only available to people aged 70+ of “good character.”

Payments began in January 1909, known nationally as Pensions Day.

1946 – National Insurance Act

Introduced a contributory system funded by National Insurance.

From 1948: Men could claim at 65, women at 60.

2016 – The New State Pension

A flat-rate system replaced the old basic and additional pensions.

Applies to:

Men born on or after 6 April 1951

Women born on or after 6 April 1953

35 qualifying years of NI for a full pension.

2025–26 maximum: £230.25 per week.

The Triple Lock Guarantee

The State Pension continues to rise each year by the highest of:

Inflation (CPI),

Average wage growth, or

2.5%.

This helps preserve its real value in retirement, although political debate about its long-term sustainability continues.

State Pension Age: Rising Gradually

The current State Pension age is 66.

Scheduled increases:

Age 67 between 2026 and 2028

Age 68 between 2044 and 2046

This reflects improvements in life expectancy.

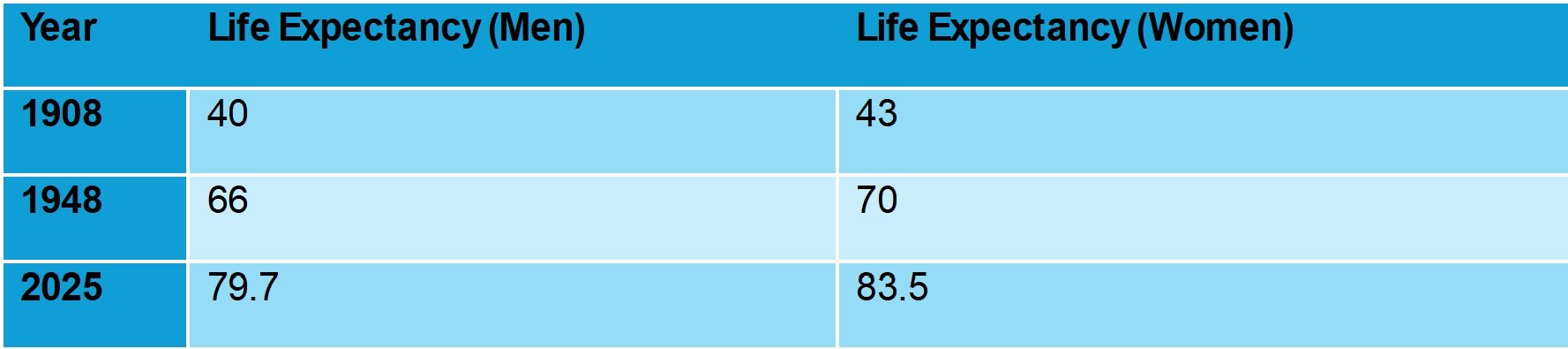

Life Expectancy Has Transformed the Purpose of the State Pension

When the pension was introduced, relatively few people lived long enough to receive it. Today, many retirees can expect 20–30+ years of retirement, making long-term planning essential.

Why the State Pension Still Matters

The full State Pension provides just under £12,000 per year, or around £24,000 for a couple. While nobody would rely solely on this for their entire retirement lifestyle, it remains:

Guaranteed

Inflation-linked

Reliable

A core building block that reduces pressure on your investment portfolio

At Ifamax, we treat the State Pension as the foundation layer in your retirement plan—helping you build a reliable, sustainable income on top through tax-efficient savings, investments, pensions and cashflow planning.

The Challenges to Plan Around

1. Rising State Pension Age

Many people will now retire years before they are eligible to claim, creating a funding gap.

Your retirement income plan needs to clearly account for this.

2. Sharp Drop in Income for Couples on First Death

When one partner dies, the State Pension stops—it isn't passed on.

This can create a significant drop in household income at precisely the time when financial stability is vital.

Understanding this risk early allows us to plan around:

Investment income,

Cash reserves,

Tax-efficient withdrawals,

Protection options where appropriate.

How Ifamax Helps You Build a Secure, Confident Retirement

At Ifamax, retirement planning doesn’t start with numbers—it starts with you.

We take time to understand:

What retirement looks like for you,

Your values, aspirations and lifestyle,

Your essential and discretionary costs,

How long your income needs to last,

How you want to protect and pass on your wealth.

Only then do we map out:

Your State Pension entitlement,

When you can claim it,

How it integrates with personal pensions and investments,

Tax-efficient withdrawal strategies,

How to protect your income through every stage of retirement.

For many clients, seeing the State Pension clearly built into their cashflow plan provides huge reassurance. It is a stable anchor that allows your wider investments to work harder and more effectively for the long term.

Final Thoughts

Many people underestimate the importance of the State Pension in their retirement planning. At Ifamax, we see it as a valuable, guaranteed building block, one that supports the long-term strategies we create to help you grow, protect and ultimately pass on your wealth.

If you're unsure how the State Pension fits into your retirement picture, or you want to build a clear, confident and tax-efficient plan, our Bristol-based financial planners are here to help.

Risk warning

This article is distributed for educational purposes only and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Reference to specific products is made only to help make educational points and does not constitute any form or recommendation or advice. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.