How to Keep Your Income Sustainable Over Time

“After decades of saving, how do you turn your pension into a reliable income for life?”

Most retirees today rely on the money they’ve saved and invested, which means the focus has shifted from accumulating wealth to decumulating it sustainably.

At Ifamax Wealth Management, we have developed a Centralised Retirement Proposition (CRP®) designed to align with the FCA’s Thematic Review of Retirement Income Advice (TR24/1). Our framework helps ensure clients can enjoy life with confidence, knowing their income strategy is robust, flexible, and sustainable.

What Are Your Options for Drawing an Income in Retirement?

It’s easy to assume that your pension is your only source of income in retirement. In reality, it’s just one piece of the puzzle.

Within your pension itself, you have three main options:

Annuity – Provides a guaranteed income for life, removing market risk but reducing flexibility.

Pension Drawdown – Keeps your pension invested, allowing flexible withdrawals that can adapt over time.

Lump Sum Withdrawals – Up to 25% tax-free, with the rest taxed as income.

However, many retirees also have ISAs, general investment accounts (GIAs), or cash savings, all of which can form part of a tax-efficient income strategy.

For example:

ISA income is tax-free.

Dividend, interest, and capital gains allowances can supplement pension income.

Unused tax-free pension cash can provide a buffer in lower-income years.

A holistic strategy that blends these sources helps reduce tax, manage risk, and extend the life of your savings.

How Much Can You Safely Withdraw Each Year?

This question has sparked debate for decades: “What’s a safe withdrawal rate for UK retirees?”

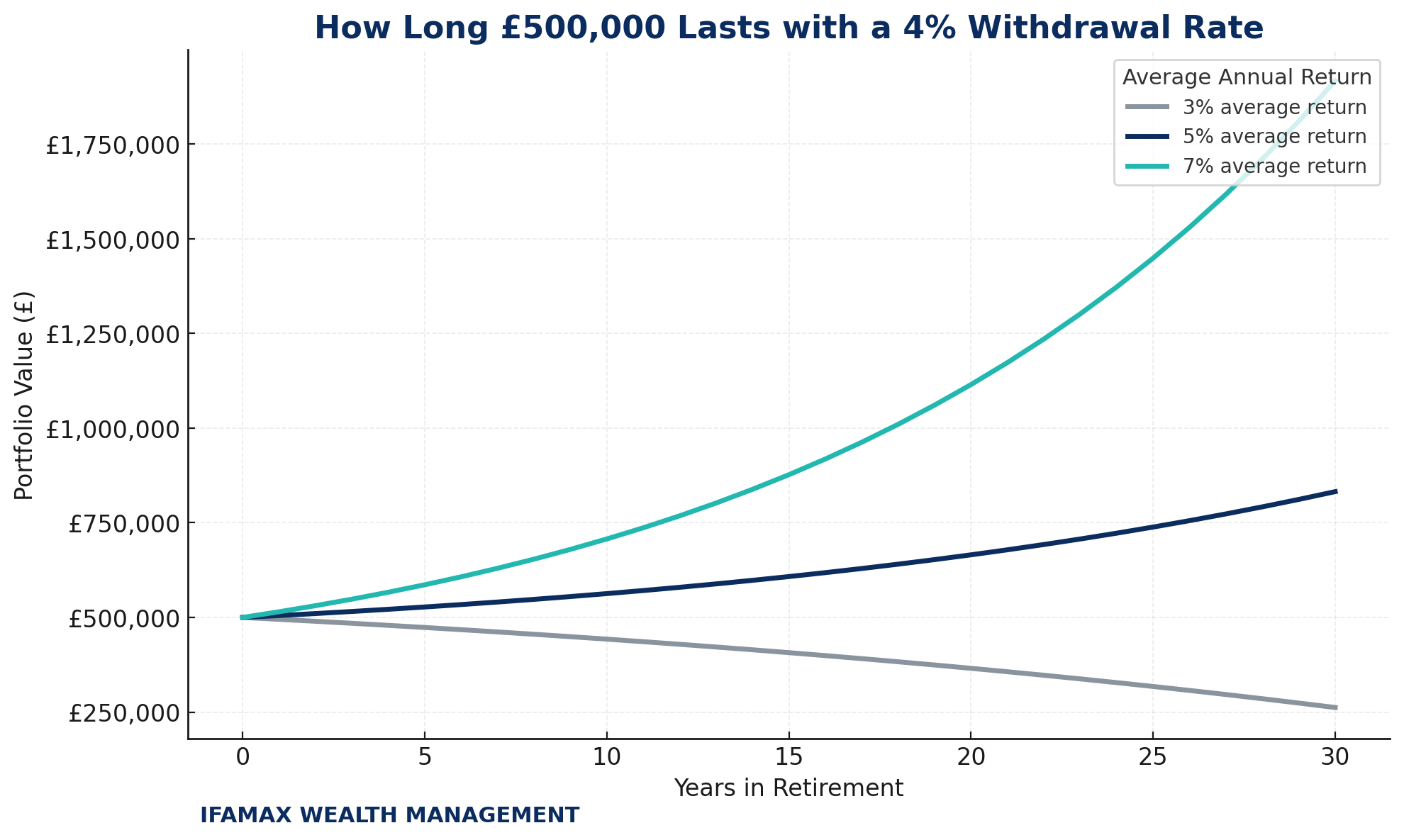

A helpful starting point is the “4% rule”, derived from William Bengen’s 1994 U.S. research, which found that withdrawing 4% of a balanced portfolio in the first year of retirement (and increasing it with inflation each year) could allow savings to last 30 years, even through major market downturns.

While this was based on American data, UK planners often use it as a guide rather than a guarantee. Factors such as fees, longevity, inflation, investment strategy, and personal flexibility all influence sustainability.

At Ifamax, we treat 4% as a guardrail, not a goal. Using advanced cashflow modelling, we test your portfolio against different market conditions and review it annually (or sooner if circumstances change).

Our Decumulation-at-Risk Policy identifies clients who may be drawing unsustainably high income levels and helps them make adjustments to stay on track. The key is ongoing monitoring and flexibility, not a static rule.

How to Keep Your Income Sustainable Over Time

The FCA expects firms to clearly distinguish between accumulation (building wealth) and decumulation (spending wealth). That doesn’t necessarily mean using completely different investments, but it does mean having a different strategy and mindset.

Key elements include:

Diversification – Spreading investments across asset classes to manage risk and inflation.

Blended income sources – Combining guaranteed income (like annuities) with flexible drawdown and other assets.

Tax-efficiency – Managing withdrawals across pensions, ISAs, and GIAs to minimise tax drag.

Regular reviews – Adjusting withdrawals as markets, inflation, and lifestyle evolve.

Research from Vanguard (2022) and the International Longevity Centre (ILC) shows that retirees who receive ongoing advice are significantly more likely to maintain sustainable income levels throughout retirement.

Why Ongoing Financial Planning Is Key

It’s tempting to see retirement planning as a one-off exercise. But as life changes, so should your income strategy.

Markets fluctuate.

Tax rules evolve.

Spending patterns shift — often higher in early retirement and lower later on.

Our annual review process ensures your income plan adapts to these realities. We model future projections, stress-test different scenarios, and make recommendations that align with your goals, risk tolerance, and evolving lifestyle.

Many clients tell us that the real value isn’t just in the numbers, but in the peace of mind that comes from knowing someone is monitoring their plan and helping them make informed, confident choices.

Summary – Turning Your Pension into Freedom, Not Uncertainty

Retirement today demands more personal responsibility than ever before. There’s no single right answer, only the strategy that’s right for you.

At Ifamax Wealth Management, our Centralised Retirement Proposition is built around the FCA’s expectations and the principle of sustainable income for life.

We help you:

Combine guaranteed and flexible income streams

Maximise tax efficiency across all your assets

Monitor your plan to ensure your money lasts as long as you do

Your retirement should be about freedom, not uncertainty.

Speak to a Bristol-based financial adviser today to create your personalised retirement income plan.

Risk warning

This article is distributed for educational purposes only and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Reference to specific products is made only to help make educational points and does not constitute any form or recommendation or advice. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.