Headlines matter. They draw people in.

We could easily retitle this article “£250,000 Needed for a Comfortable Retirement”; it would almost certainly generate clicks. But the truth is that the figure would be entirely arbitrary.

And that’s the problem with how retirement is often discussed.

At the start of the year, many people pause to reflect and realign their priorities.

Retirement planning naturally fits into that mindset. This blog continues that theme by stepping away from headline numbers and focusing on something far more important: what retirement actually looks like for you.

What does retirement really look like?

It would be easy to turn this into a numbers exercise, but retirement is more nuanced than that.

The FCA’s Retirement Income Advice Assessment Tool (RIAAT) provides a helpful framework. It encourages financial planners to look beyond total wealth and understand:

Essential spending

Lifestyle spending

Discretionary spending

Priorities and trade-offs

Before asking how much you need, you first need to understand how you want to live.

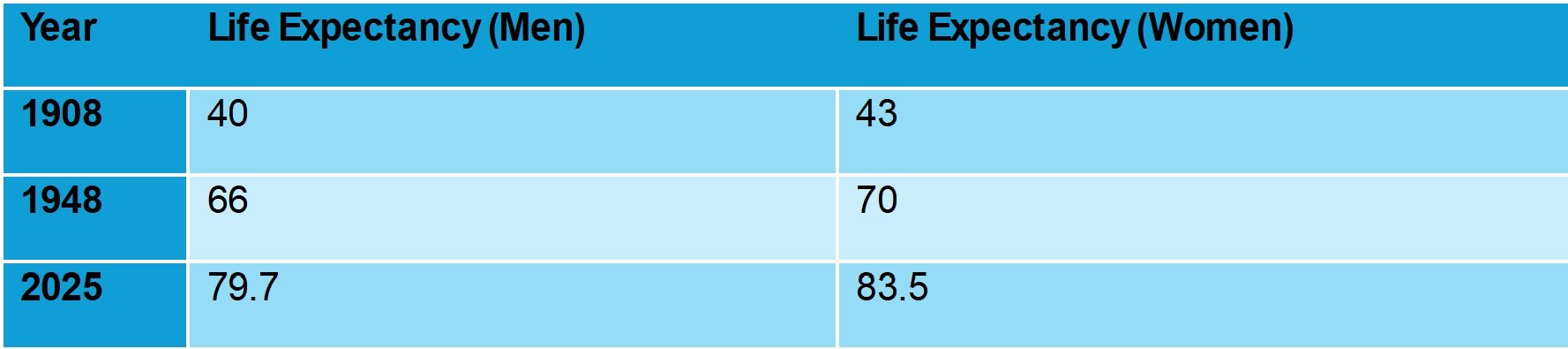

For some people, retirement may still include mortgage or rent payments. Others may be supporting family members, planning to travel, or easing into retirement gradually. Every situation is different.

Where does retirement income come from?

Once lifestyle needs are clear, the next step is understanding how income will be delivered.

Retirement income is rarely drawn from a single pot. While pensions often take centre stage, many people also hold:

ISAs

Investment portfolios

Property assets

Cash savings

In some cases, crypto assets

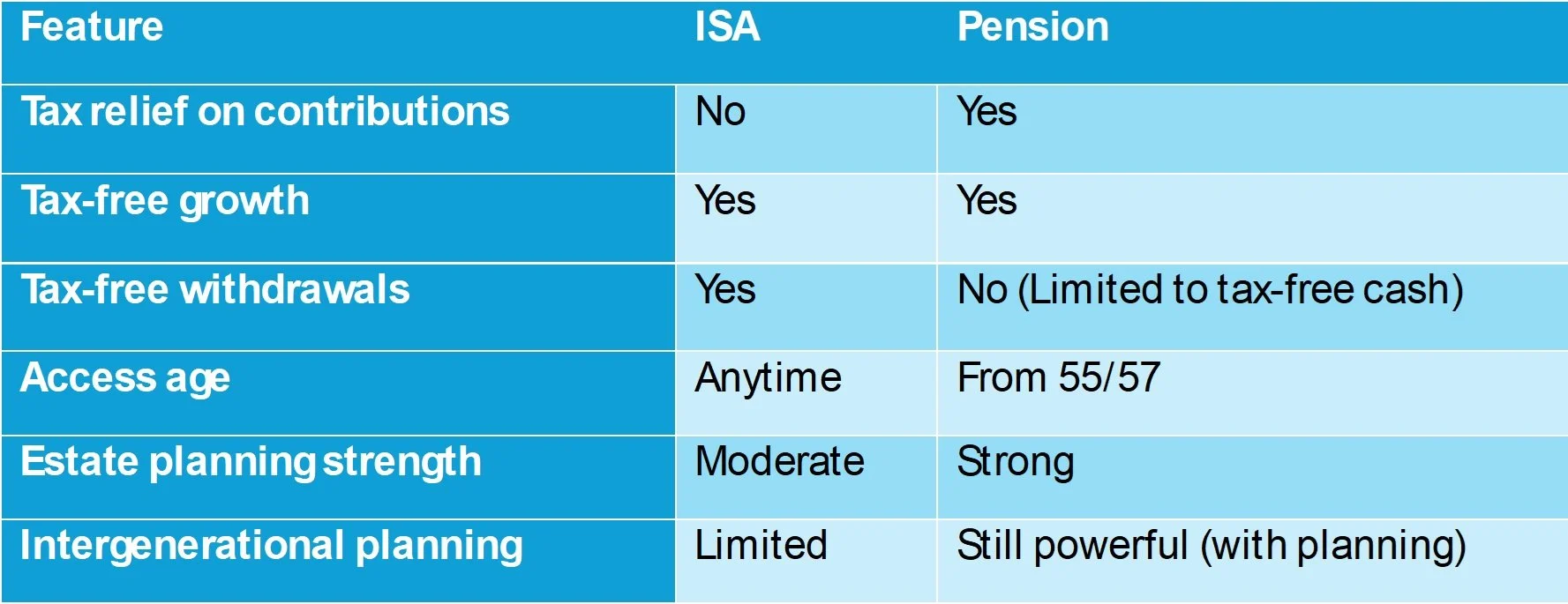

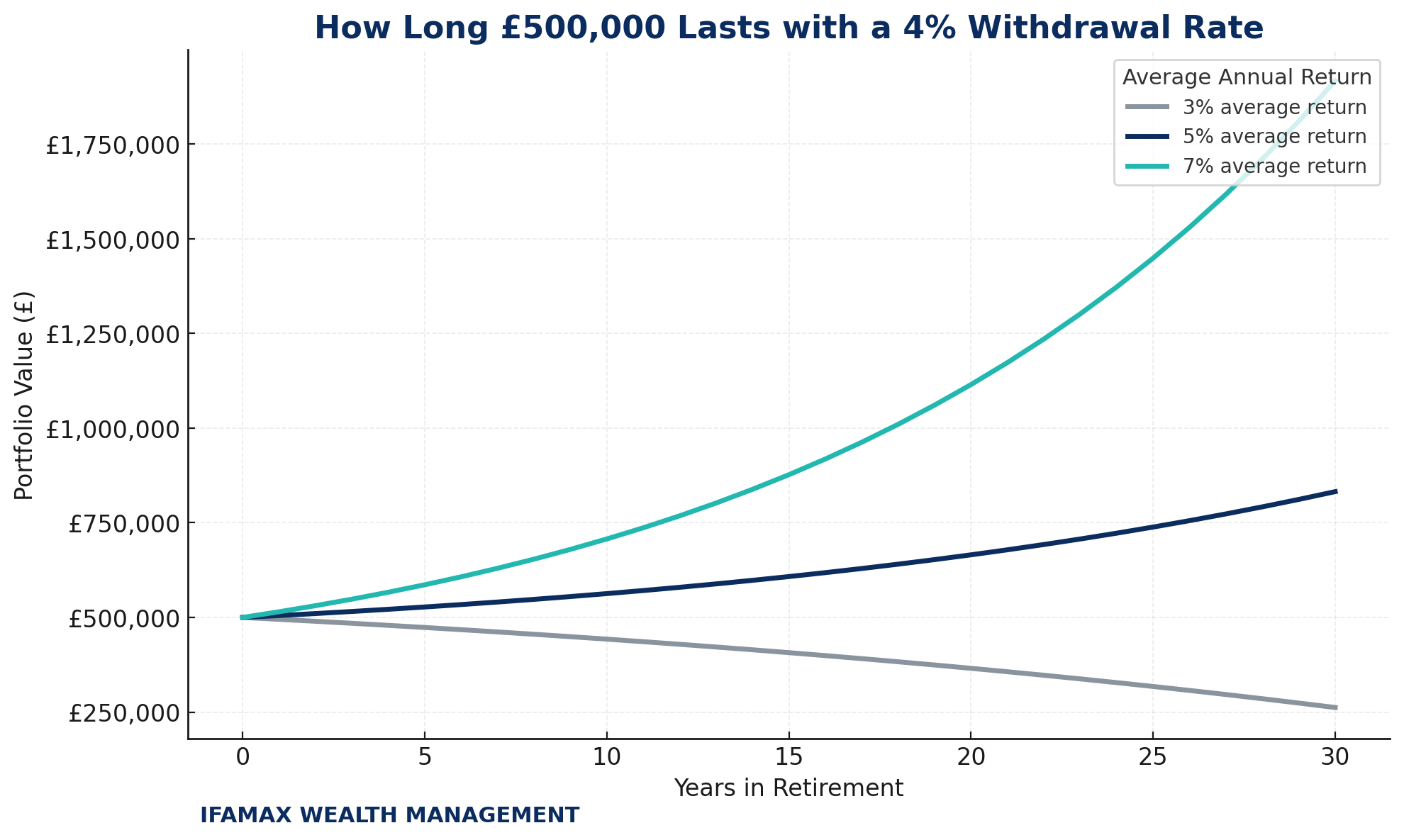

The FCA has been clear that retirement income should be delivered in the most tax-efficient way possible. For example, ISA income is tax-free, which can significantly improve sustainability over time.

Looking at all assets together, rather than in isolation, often creates more flexibility and resilience.

Retirement: a new job, a new season

Beyond the numbers, retirement is effectively a new job, but one where you write the job description.

We spend a great deal of time helping clients think through what a typical day, week or month might look like in retirement. For people who have had structure and routine throughout their working lives, this transition can be surprisingly challenging.

The psychological and behavioural aspects of retirement are just as important as financial projections. A successful retirement is not only about income, it’s about purpose, rhythm and confidence.

So… how much do you actually need?

It could be £250,000.

It could be £1 million.

It could be £100,000.

There is no universal answer.

What matters is that the number reflects your journey, your assets, your lifestyle, your priorities and how your income will be delivered over time.

As more people approach retirement, we believe the conversation needs to move away from headline figures and towards thoughtful, personalised planning. Retirement isn’t an ending, it’s a new chapter.

Frequently Asked Questions

Is there a “comfortable retirement” number in the UK?

No. What feels comfortable varies widely depending on lifestyle, housing costs, health, family commitments and expectations.

Should I focus on my pension value?

Your pension is important, but it’s rarely the whole picture. ISAs, investments, property and other assets often play a role in retirement income.

How important is tax efficiency in retirement?

Very. Delivering income tax efficiently can significantly extend asset lifespans and improve flexibility.

Can non-traditional assets support retirement?

In some cases, yes. Assets such as property or realised crypto gains may form part of a broader retirement strategy when planned carefully.

When should I start planning for retirement?

Ideally, well before retirement begins. Early planning creates more options, but clarity at any stage is valuable.

Important note

This article is distributed for educational purposes only and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Reference to specific products is made only to help make educational points and does not constitute any form or recommendation or advice. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.